So the UK is officially in a technical recession. I don’t know about anyone else, but it feels like we’ve been in a recession for a long time now given the cost of living crisis, geopolitical tensions, supply chain issues and the hangover we have from the pandemic.

In fairness, the UK economy has been somewhat resilient in the face of all this, yet in February this year it’s been confirmed that GDP has turned red for two consecutive quarters, officially plunging the UK into a technical recession.

Whilst we’re not in the business of economic forecasting, we take an active interest in UK economic data as it helps us as a business plan forward and manage risk accordingly. In this article we’re going to look at how bad this recession could get, the impact it’s currently having, and could have, on our industry.

As with all economic forecasting, any predictions made in this article will likely be wrong. As you can imagine, predicting the future is extraordinarily difficult and with the level of volatility we see in just about everything right now, it’s even more of a challenge. However, we hope some of the points we raise here will be useful thought starters, or topics of debate over an increasingly expensive pint.

So here is our look at the good, the bad and the ugly when it comes to the UK economy.

The good – resilience in the face of uncertainty

Following the pandemic, war in Ukraine, major supply chain breakdowns and ongoing geopolitical tensions, it would’ve been easy to assume that this country was facing collapse. However, thus far, it hasn’t played out that way. As a nation we’ve certainly faced our challenges and economic hits, but the downturn we’ve experienced to date has been somewhat muted.

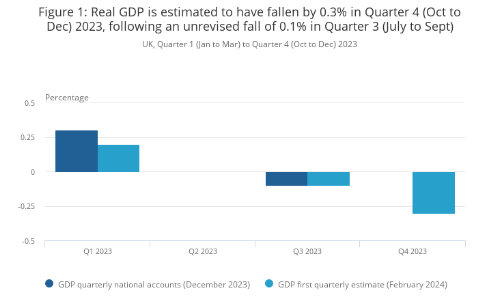

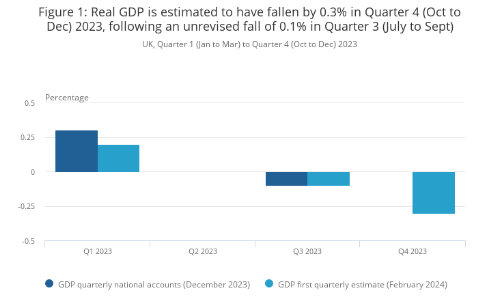

We saw GDP drop 0.1% in Q3 and 0.3% in Q4 last year. These aren’t the massive declines predicted by the gloomiest of commentators at the beginning of 2023. That’s not to say much worse isn’t yet to come, and some of this article will be covering some things that could make this substantially worse, but so far the UK has held up pretty well.

Source: https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/octobertodecember2023

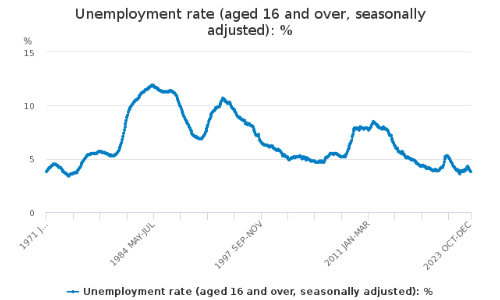

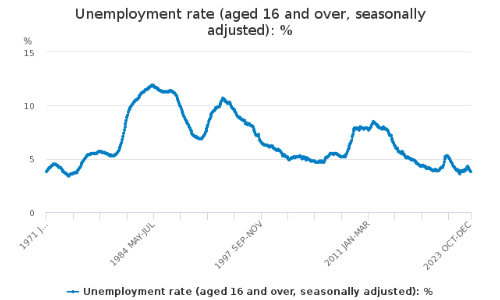

Something else that has surprised many is how low the unemployment rate has remained. According to the ONS, in December 2023 the unemployment rate in the UK stood at 3.8%, among one of the lowest rates we’ve seen on record. Now I know many will question the official data and how it’s easily swayed, but even so, a meaningful drop in employment would’ve become more apparent. To add an anecdotal observation to the mix, I hear more stories about labour shortages and the difficulty finding people than I do about redundancies.

Source: https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/timeseries/mgsx/lms

Whilst there are many other things to be optimistic about, I know you doom-mongers reading this blog want to get past the silver-lining statistics and get to the disasternomics lying in wait…

The bad – signs of trouble emerging

Unfortunately, not everything is smelling of roses. There are significant concerns going forward that should be on our radars.

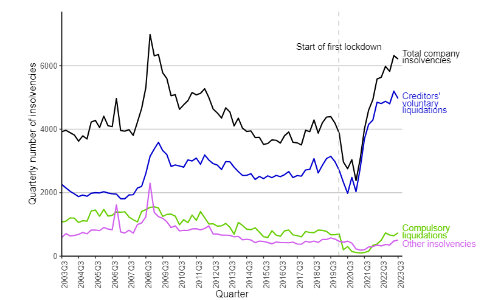

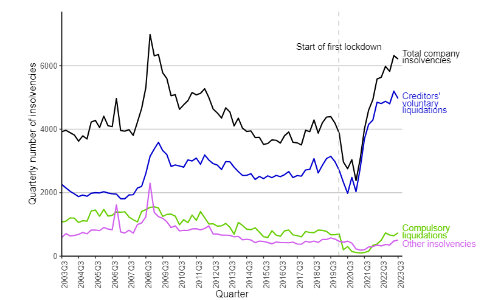

First, the number of business insolvencies we’re seeing in the UK has risen dramatically to a 30-year high. In 2023 more than 25,000 companies registered for insolvency which suggests storm clouds are gathering on the horizon with a potential hit to employment added to the mix.

Source: https://www.gov.uk/government/statistics/company-insolvency-statistics-july-to-september-2023/commentary-company-insolvency-statistics-july-to-september-2023

Something else that has sent some alarm bells ringing is UK consumer spending in the latter months of 2023 and going into January this year. Whilst they’re not catastrophic by any means, they’ve fallen well under expected annual growth rates and are telling us that the consumer is struggling. Retail sales grew at an annual rate of 1.7% in December 2023 which was down 2.7% on the previous month and below the 3.6% 12-month average.

Another canary in the coalmine is the construction industry - the broader industry we operate within as a business. There were over 4,300 construction industry insolvencies in 2023, which was a rise of more than 5% year on year, and an increase of almost 38% pre-pandemic. There also doesn’t appear to be any signs emerging just yet of this reversing. Construction has traditionally been a leading indicator of the economy at large and when we see construction struggling, it normally warns us of economic difficulty.

Whilst we earlier highlighted the unemployment rate as being an indicator of resilience, it should also be noted that we’ve been seeing redundancies across the board over the last few months. We also saw the number of planned redundancies shoot up by 54% in the summer with firms including John Lewis, Rolls-Royce, KPMG and PwC announcing large rounds of redundancies.

As you can see, there’s plenty of concerning datapoints and indicators of trouble ahead. However, this is barely scratching the surface. There are some much bigger areas of concern that mean this may not be your garden-variety type of downturn.

So, let’s take a look at the downright ugly…

The ugly – long term problems meet new global risks

Whilst we’re now in a technical recession, I don’t think it’s this recessionary period that’s necessarily concerning most people. After all, a couple of quarters of slightly negative growth is not the stuff dystopian futuristic novels are made of, yet there’s certainly an apocalyptic air to the times we’re living through.

Firstly, Britain has a major debt problem. The debt that’s held both publicly and privately is unsustainable and these fears have been voiced by both the Office for Budget Responsibility (OBR) and the Bank of England. And that’s just current debt levels. Public debt at the end of 2023 stood at £2.5 trillion (a number I simply can’t comprehend) and when we look at the country’s unfunded debt obligations, we can add multiple trillions to that number.

This has already become a major issue for both public and private finances. Following the pandemic, and multiple shocks since, the UK base rate shifted from 0.1% to 5.25% now to battle the high levels of inflation we’ve experienced. Why is this a problem?

Well it’s a huge problem given the amount of debt in the system. With zero-interest rate policy (ZIRP) in place for as long as it was, as a nation we binged on debt, simply because the cost of borrowing was so low. That cost of borrowing has now risen dramatically, despite the base rate still only hovering around its historical average and has resulted in debt-servicing costs skyrocketing. Ask anyone who took out a 2-year fixed mortgage between 2020-2022 to buy a property, you’ll find that their repayments have increased from anywhere between 50% to 100% or more, purely to cover the interest.

This means that there’s less capacity in the system to fuel economic growth. Those with large mortgages are seeing their levels of disposable income get destroyed which is now having a significant knock-on effect in the broader economy.

It gets worse…

Despite the rapid increase of interest rates, inflation remains stubbornly high and the hoped-for rapid drop in rates aren’t manifesting as people had anticipated. This means the debt-servicing costs are going to remain higher for longer, and that’s even before we discuss any other potential shocks that could cause further rate increases. With hundreds of thousands more households set to shift to new terms on their mortgages this year, after the millions seen since rates rose, you can see that this is likely going to be a major drag on growth going forward.

On top of this is the level of uncertainty we face. The news is now filled with war, impacts of ecological decline, supply chain issues, new viruses of pandemic-potential, AI replacing humans and the general ongoing decline of civilised society. I know that sounds quite doom-mongery, but that’s the modern reality we’re faced with day to day right now.

What does it all mean for the construction industry?

To be honest, it’s likely to be a mixed bag. As we’ve seen, the construction sector has taken a hit. In fact, there was a clear decline becoming apparent across almost the entirety of 2023. However, like most things in life, there’s more to this than meets the eye.

Whilst we’re seeing a big hit to new residential builds, which has led to a large uptick in construction insolvencies, there’s a number of other things playing out that mean there are still areas of opportunity and growth within the sector. Firstly, new regulation is arriving to the industry in waves. Following Grenfell and the Hackitt report, new fire safety and maintenance guidelines are beginning to force the hand of building owners to modernise their facilities to meet new standards.

This is one area we’re particularly interested in at Door Controls Direct. Following the Fire Door Inspection Scheme’s release of data from 100,000 inspections across the country, it became clear that close to three quarters of all doors fail and given the shift of responsibility we’ve seen in recent regulations means funding for rectifying the problem is a growing priority in budgets.

If we’re to see a rise in unemployment, there could also be another potential benefit to the construction industry. With many tech and retail firms announcing major rounds of redundancies, construction may become an attractive proposition for those seeking an opportunity. The construction industry has been slower to digitise than others and a flood of digital talent to the sector could help modernise this industry, a long overdue evolution, in a way we’ve not seen before.

On top of all this, Britain’s infrastructure needs modernisation. Whilst the investment is not there now, a change of government will likely lead at some point to an influx of investment to bring the country up to speed. Of course, this assumes the country is in a position to do this. Sadly, that’s far from certain.

Comments